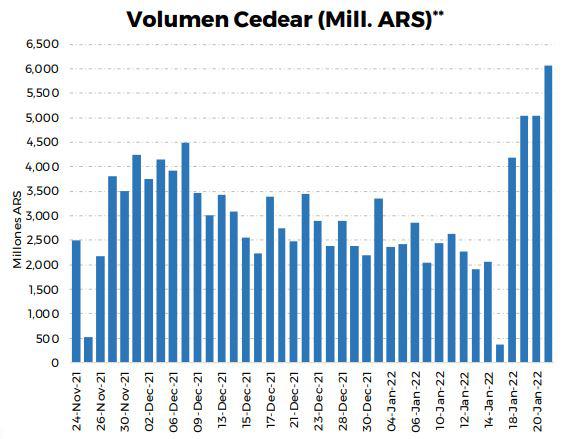

Cedears ETFs: which were the most traded and which ones are recommended by analysts

Bano also highlighted that on Thursday, the appetite for the index that replicates the S&P 500 was also joined by the one that follows the Dow Jones with $507 million and that of the Financial sector with $300 million. “In the SPY you are buying a stake in the 500 largest companies in the United States, the XLF are all companies in the financial sector, the XLE replicates the energy sector and the ARKK is the innovation sector that no longer replicates an index but has a active administration that invests only in companies that develop disruptive technologies”, he described.

Cedears ETFs are currently trading between $1,700 and $7,000. “As an investment product it is fantastic. You operate it in pesos, in Argentina, and you are investing in packages of good companies,” he said, but warned: “You have to keep in mind the moment of the stock market in the United States. Since the beginning of the year he has not had a good performance. There are interesting sectors, such as the energy sector, it is one of the few that performed well”.

“These products are designed for a long-term vision. You could here take a position as a portfolio foundation in something like these ETFs, which is a very cheap investment. The S&P has risen in the last 5 years, 123%, the Nasdaq has grown 220%, and the Dow Jones 100%. They are very interesting real returns of between 20 to 26% of annual yield”, closed Bano.

Diego Burzaco, Head of Research & Strategy at Inviu, also analyzed the first days of these instruments and highlighted that "there was a lot of interest from a more sophisticated retail public", he also highlighted that there was "a lot of liquidity" and that "it is positive to be able to buy and sell when you think it's relevant” from the investor's point of view.

“It is an interesting instrument that was not in Argentina and in times where there is a lot of demand for instruments that do not have the Argentine risk and that can be invested in pesos. It works for foreign exchange coverage or even for investment in currency that is tied to the hard currency in the long term”, expanded the analysis.

Regarding the international context, he assured that "it was a pretty tough week on Wall Street" because "we are going through the worst week on Wall Street since March 2020 and it puts pressure on the price of instruments at the local level."

On the important points to take into account when investing, he clarified that "beyond what may become the fashion of a product, the investment must be evaluated in the medium term." “It's a good way to diversify, and that has lower risks. For any average portfolio that is assembled in the local market in pesos, it is a product that is going to be taken into account in any investment portfolio”, he concluded.